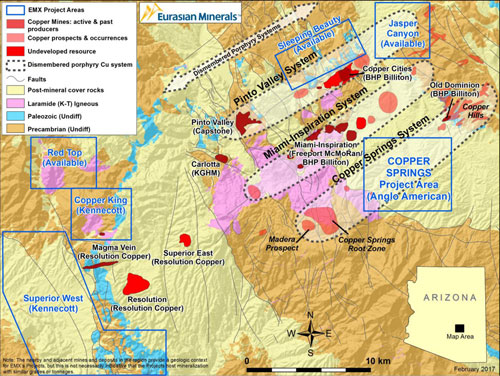

Vancouver, British Columbia, February 28, 2017 (TSX Venture: EMX; NYSE MKT: EMX) - Eurasian Minerals Inc. (the “Company” or “EMX”) is pleased to announce the execution of an Option Agreement (the “Agreement”), through its wholly owned subsidiary Bronco Creek Exploration, Inc. (“BCE”), for the Copper Springs porphyry copper project (the “Project”) with Anglo American Exploration (USA), Inc. (“Anglo American”). The Project is located approximately 120 kilometers east of Phoenix, Arizona within the Globe-Miami Mining District and represents one of three porphyry copper projects acquired in the district through EMX’s generative efforts. The Copper Springs Project covers the majority of a newly recognized, southern porphyry copper trend. Please see attached map and www.eurasianminerals.com for more information.

Commercial Terms. (Note: all dollar amounts in USD) Pursuant to the Agreement, Anglo American can earn a 100% interest in the Project by (a) reimbursing BCE’s 2016 holding and permitting costs and making annual option payments, together totaling $447,000, and (b) completing $5,000,000 in exploration expenditures before the fifth anniversary of the Agreement. Upon exercise of the option, Anglo American will pay EMX an additional $110,000 and EMX will retain a 2% NSR royalty on the Project. The royalty is not capped or purchasable, except over two parcels of Arizona State Land where Anglo American can buy a 0.5% NSR royalty from EMX for $2,000,000.

After exercise of the option, annual advance minimum payments (“AM Payments”) of $100,000 are due, commencing on the first anniversary of the exercise of the option. The AM Payments will increase to $200,000 upon completion of a Scoping Study or Preliminary Economic Assessment (“PEA”). Anglo American may make a one-time payment of $3,500,000 to extinguish the obligation to make any post-Scoping Study AM payments. All AM Payments cease upon commencement of production from the Project.

In addition, Anglo American will make milestone payments consisting of:

- $500,000 upon completion of a Scoping Study or PEA;

- $1,000,000 upon completion of a Prefeasibility Study; and

- $2,000,000 upon completion of a Feasibility Study. The Feasibility Study payment will be credited against future royalty payments.

Anglo American will manage and operate the Project.

Project Overview. The Copper Springs Project is located in the southern part of the Globe-Miami Mining District and is comprised of 262 unpatented federal mining claims and two State of Arizona Exploration Permits totaling ~6,182 acres. Porphyry copper deposits within the district have been structurally dismembered and rotated by younger, post-mineral faulting.

EMX geologists identified the Project’s porphyry copper potential from their regional generative work, and acquired the Project through staking and obtaining state exploration leases. New geologic interpretations led to the recognition that the west side of the district is characterized by deep, porphyry root zone-styles of alteration and mineralization (Madera-Copper Springs/Lonesome Pine prospects) while the east side is characterized by shallow, porphyry-related vein and replacement mineralization (Old Dominion Mine & Copper Hills). Between the two zones lie highly prospective, but largely untested down-dropped blocks covered by younger basin fill. These targets represent a previously unrecognized porphyry trend, within the EMX land position.

To date, EMX has completed geologic mapping, structural reinterpretation, and a gravity survey to aid in drill targeting and has begun permitting for an initial drill program. Previous partner funded work included two drill holes which ended in conglomeratic basin fill. The deepest hole included intervals containing native copper, ended at 670 meters, and was subsequently cased to 512 meters for possible future re-entry. EMX and Anglo American are in the process of finalizing exploration plans.

The Copper Springs Agreement is another example of EMX executing the prospect and royalty generation business model to advance its portfolio with quality partners. EMX is enthusiastic to work with Anglo American at Copper Springs and now has three of its six projects in the Globe-Miami and Superior Districts partnered and advancing with major mining companies (see EMX news releases dated May 4, 2015 and October 19, 2016).

Note: The nearby and adjacent mines and deposits in the region provide a geologic context for EMX’s Project, but this is not necessarily indicative that the Project hosts mineralization with similar grades or tonnages.

Mr. Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved disclosure of the technical information contained in this news release.

About EMX. Eurasian Minerals leverages asset ownership and exploration insight into partnerships that advance our mineral properties, with EMX retaining royalty interests. EMX complements its generative business with strategic investment and third party royalty acquisition.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@EurasianMinerals.com

Website: www.EurasianMinerals.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

Email: SClose@EurasianMinerals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause Eurasian’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the nine-month period ended September 30, 2016 (the “MD&A”), and the most recently filed Form 20-F for the year ended December 31, 2015, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the 20-F and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.