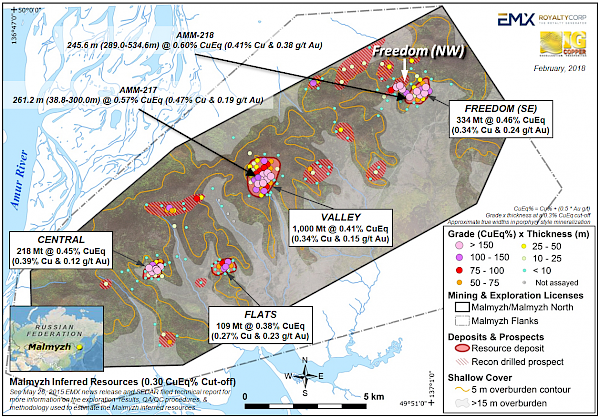

Vancouver, British Columbia, March 5, 2018 (TSX Venture: EMX; NYSE American: EMX) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce that IG Copper LLC (“IGC”) has advised that the winter drill campaign is underway at the Malmyzh copper-gold porphyry project. The first two holes were drilled to acquire material for metallurgical test work from the Valley and Freedom Southeast resource deposits. The drill results include a near-surface intercept at Valley of 261.2 meters (38.8-300.0 m) averaging 0.57% copper equivalent (0.47% copper and 0.19 g/t gold), including a higher grade sub-interval of 64.0 meters (128.0-192.0 m) averaging 0.81% copper equivalent (0.66% copper and 0.31 g/t gold) from hole AMM-217. At Freedom Southeast, hole AMM-218 returned an intercept of 245.6 meters (289.0-534.6 m) averaging 0.60% copper equivalent (0.41% copper and 0.38 g/t gold), with a higher grade sub-interval of 86.0 meters (389.0-475.0 m) averaging 0.96% copper equivalent (0.62% copper and 0.69 g/t gold). The campaign is now focused on drill delineation of the breccia pipe hosted copper-gold mineralization at the Freedom Northwest prospect, which is not included in the current Malmyzh resource estimate. Please see the attached map and www.emxroyalty.com for more information.

As an important step forward for the Malmyzh project, IGC advises that Scotiabank Europe plc, the U.K. subsidiary of The Bank of Nova Scotia, has been retained to assist with IGC’s strategic business initiatives. Scotiabank is a leading financial institution in international banking and markets, with widely recognized expertise in advisory services for the natural resources and mining sectors. EMX is pleased with IGC’s engagement of Scotiabank to help realize the full potential of Malmyzh.

The Malmyzh exploration and mining licenses, located in Far East Russia, are held by IGC (51%) and Freeport-McMoRan Exploration Corporation (49%), with IGC operating and managing the project. EMX is IGC’s largest shareholder with 42% of the issued and outstanding shares (39% on a fully diluted basis).

Winter Drill Campaign. IGC’s winter campaign metallurgical holes were designed to provide representative mineralized material from the Valley and Freedom Southeast resource deposits. At Valley, hole AMM-217 intersected a zone of near-surface copper-gold mineralization hosted in hornfels and lesser granodiorite with K-feldspar+silica-sericite-biotite alteration. Hole AMM-218, at Freedom Southeast, intersected higher grades in both an upper chalcocite enriched zone, and a lower zone of silica-sericite-biotite-magnetite dominant alteration with high gold to copper ratios. The higher grade zones in AMM-218 occur within a broad mineralized envelope of sericite-chlorite altered (quartz) diorite porphyries. Select drill intercepts are summarized below (intercepts interpreted as approximate true widths in porphyry style mineralization).

|

Drill Hole |

From (m) |

To (m) |

Length (m) |

CuEq % |

Cu % |

Au g/t |

Comments |

|

AMM-217 |

38.8 |

300.0 |

261.2 |

0.57 |

0.47 |

0.19 |

Valley |

|

including |

128.0 |

192.0 |

64.0 |

0.81 |

0.66 |

0.31 |

|

|

AMM-218 |

28.0 |

126.4 |

98.4 |

0.43 |

0.33 |

0.21 |

Freedom Southeast |

|

including |

28.0 |

51.0 |

23.0 |

0.68 |

0.50 |

0.35 |

|

|

|

289.0 |

534.6 |

245.6 |

0.60 |

0.41 |

0.38 |

|

|

including |

389.0 |

475.0 |

86.0 |

0.96 |

0.62 |

0.69 |

CuEq% = Cu% + (Au g/t x 0.5)1.

The proposed metallurgical work program will initially consist of bench scale testing to optimize the processing flowsheet for copper and gold recoveries.

IGC is now following-up on previous drill results from the Freedom Northwest breccia pipe. These earlier results include the longest Malmyzh drill intercept to date from hole AMM-213, which intersected 747.4 meters (108.7-856.1 m) averaging 0.49% copper equivalent (0.41% copper and 0.17 g/t gold), as well as hole AMM-216 which intersected 417.3 meters (219.4-636.7 m) averaging 0.60% copper equivalent (0.50% copper and 0.21 g/t gold), including a higher grade sub-interval of 142.6 meters (255.4-398.0 m) averaging 0.74% copper equivalent (0.62% copper and 0.26 g/t gold) (true widths)2. Chalcopyrite-rich and chalcopyrite-bornite-magnetite mineralization is principally hosted in polymictic magmatic-hydrothermal breccias, and to a lesser extent in intrusive and phreatomagmatic breccias, diorite porphyries and hornfelsed sandstones. Higher grade intervals appear to coincide with increased percentages of quartz-chalcopyrite-magnetite vein clasts in the breccias. The interpreted breccia pipe at Freedom Northwest generally coincides with a nearly circular anomaly (~800 m diameter) defined from IGC’s high resolution ground magnetics survey, and from drill results to date extends to depths of ~650 to over 850 meters.

The high resolution magnetics data have been an important exploration tool for delineating drill targets at Freedom. Further work over the Valley resource deposit has highlighted a more subdued, yet distinctively stippled semi-circular magnetic signature. Similar patterns are observed in the magnetics data over the Central resource deposit and the North prospect. Property-wide, the magnetics surveys now total 667 line kilometers. IGC looks forward to drill testing targets prospective for high grade mineralization during 2018.

Project Overview. Malmyzh is located in Far East Russia, approximately 220 kilometers northeast of the city of Khabarovsk and the nearby border with China. The project has excellent physiographic, infrastructure and logistical characteristics, and is situated in the low relief hills of the Amur River valley, which is the major shipping river in the region. There are multiple options for transportation besides the Amur that include an adjacent paved Federal highway and regional rail facilities. As well, Malmyzh has nearby and readily available power and water sources.

The Malmyzh porphyry district occurs within a 16 by 5 kilometer intrusive corridor concealed beneath a thin veneer of in-situ soil and regolith. Copper-gold mineralization extends from shallow subcrop (~1 to 50 meters) to depths of 400 to more than 850 meters. The porphyry centers occur as Cretaceous-age dioritic stocks that intruded and hornfels-altered siltstone and sandstone sedimentary sequences.

Four resource deposits (i.e., Valley, Central, Freedom Southeast, and Flats) were the focus of previous work. The Malmyzh open pit constrained inferred resources at a 0.30% copper equivalent cut-off are 1,661 million tonnes at average grades of 0.34% copper and 0.17 g/t gold, or 0.42% copper equivalent, containing 5.65 million tonnes (12.45 billion pounds) copper and 9.11 million ounces gold, or 7.06 million tonnes (15.56 billion pounds) copper equivalent3. There are at least eleven additional porphyry prospects, including Freedom Northwest, that have undergone various degrees of reconnaissance drilling.

EMX’s strategic investment in IGC exemplifies the Company’s recognition of an early-stage opportunity with excellent growth potential. IGC has steadily built value at Malmyzh while adding quality exploration properties to its portfolio.

1 Copper equivalent calculated as CuEq% = Cu% + (Au g/t x 0.5),with assumed prices of $3.25/lb Cu and $1400/oz Au, and recoveries of 90% for Cu and 70% for Au.

2 See EMX news release dated July 25, 2017.

3 Phil Newall, PhD, BSc, CEng, FIMMM, a Qualified Person under NI 43-101 and managing director of Wardell Armstrong International, an independent UK based consulting company, provided the statement of Malmyzh inferred resources under NI 43-101 Standards of Disclosure for Mineral Projects and CIM definition standards. See May 26, 2015 EMX news release and SEDAR filed technical report titled “NI 43-101 Technical Report on the Initial Mineral Resource Estimate for the Malmyzh Copper-Gold Project, Khabarovsk Krai, Russian Federation” with an effective date of May 1, 2015and dated July 10, 2015 for more information on the exploration results, QA/QC procedures, & methodology used to estimate the Malmyzh inferred resources.

Drilling, Sampling, Assaying, and QA/QC. The Malmyzh drill samples were collected in accordance with CIM Best Practice standards and guidelines. The samples were submitted to Irgiredmet Laboratories in Irkutsk, Russia (GOST ISO/MEK 17025 accredited) for assay and geochemical analysis. Gold was analyzed by fire assay with an AAS finish, and copper analyses were determined with aqua regia digestion and ICP AES techniques. IGC conducts routine QA/QC analysis on all assay results, including the systematic utilization of certified reference materials, blanks and duplicates.

Mr. Dean D. Turner, CPG, is a Qualified Person under NI 43-101 and consultant to the Company. Mr. Turner has reviewed, verified and approved disclosure of the technical information contained in this news release.

About EMX. EMX leverages asset ownership and exploration insight into partnerships that advance our mineral properties, with EMX receiving pre-production payments and retaining royalty interests. EMX complements its royalty generation initiatives with royalty acquisitions and strategic investments.

About IGC. IGC, a privately held company, is led by President and CEO Thomas E. Bowens, and includes key personnel with a track record of exploration discovery and project development in the Russian Federation.

-30-

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

Email: SClose@EMXroyalty.com

Website: www.emxroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2017 (the “MD&A”), and the most recently filed Form 20-F for the year ended December 31, 2016, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the 20-F and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Cautionary Note to U.S. Investors Concerning Estimates of Inferred Resources

This news release uses the term “Inferred Resources”. We advise U.S. investors that while this term is defined in, and permitted by, Canadian regulations, this term is not a defined term under SEC Industry Guide 7 and not normally permitted to be used in reports and registration statements filed with the SEC. “Inferred Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. Under Canadian rules, estimates of Inferred Mineral Resources may not be converted to Mineral Reserves or form the basis of feasibility or prefeasibility studies. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves”, as in-place tonnage and grade without reference to unit measures. U.S. investors are cautioned not to assume that any part or all of mineral deposits in this category will ever be converted into reserves. U.S. investors are cautioned not to assume that any part or all of an Inferred Resource exists or is economically mineable.