Diablillos

Location

Argentina

Operator

AbraSilver Resource Corp.

Commodity

Silver-Gold

Royalty

1% NSR

EMX has a 1% NSR royalty on the Diablillos project. Diablillos is a high sulfidation silver-gold & copper-gold porphyry intrusive at depth project, located in the Puna region of the Province of Salta, Argentina and is operated by AbraSilver Resource Corp. (TSX-V: ABRA, “AbraSilver”). Abra has an option to acquire 100% of the Diablillos property, with one remaining payment to EMX due by the earlier of the date on which commercial production occurs at Diablillos, or July 31, 2025. (see EMX Press Release dated July 29, 2021).

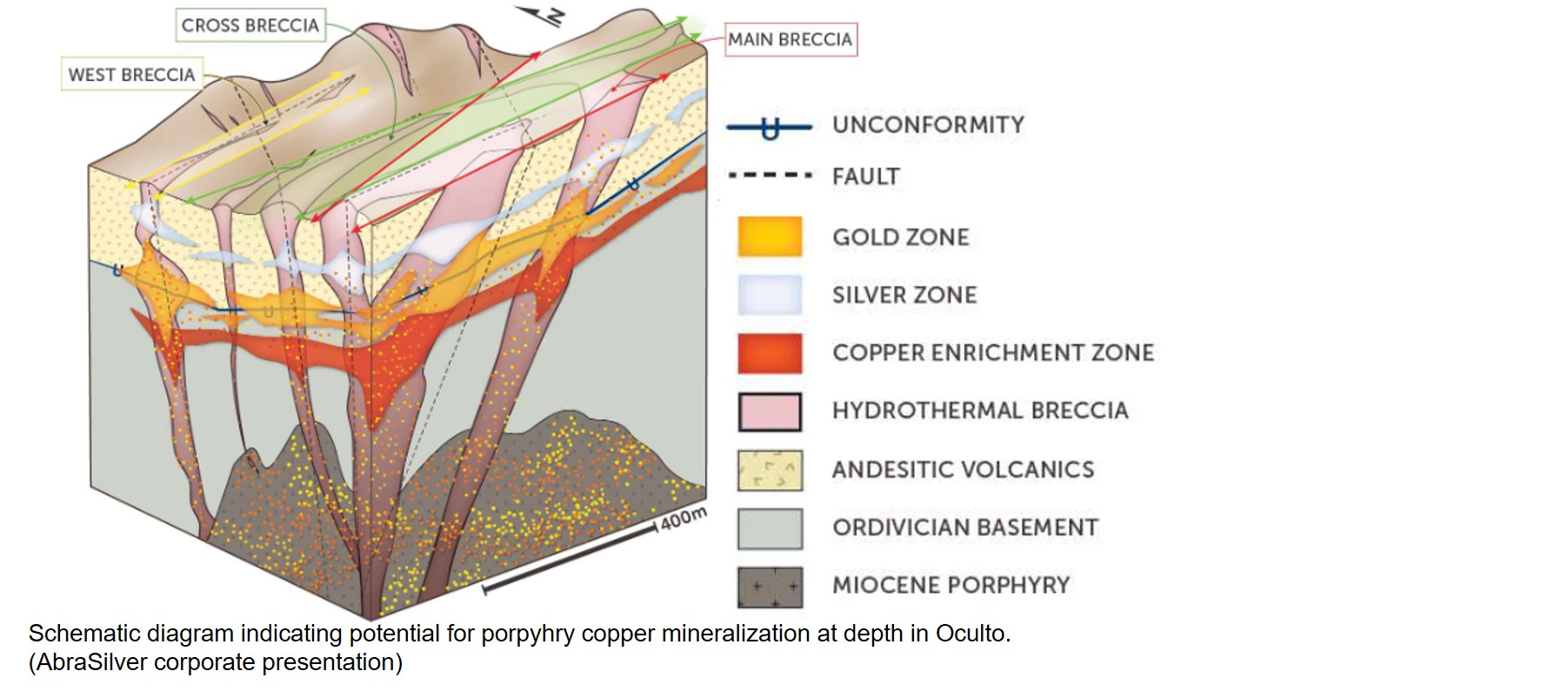

There are currently several known mineralized zones on the Diablillos property, with the Oculto zone being the most important and the most explored. Oculto is a deeply oxidized, high-sulfidation epithermal silver-gold deposit. Recent surface mapping and drill data interpretation indicates that high grade mineralization at Oculto is strongly correlated with steeply dipping, tabular, hydrothermal breccia bodies oriented along northeast-trending faults. Recent drilling confirmed that these hydrothermal breccias continue into the basement and identified high-grade copper intercepts up to 5% Cu, suggesting the potential for deeper porphyry-style mineralization.

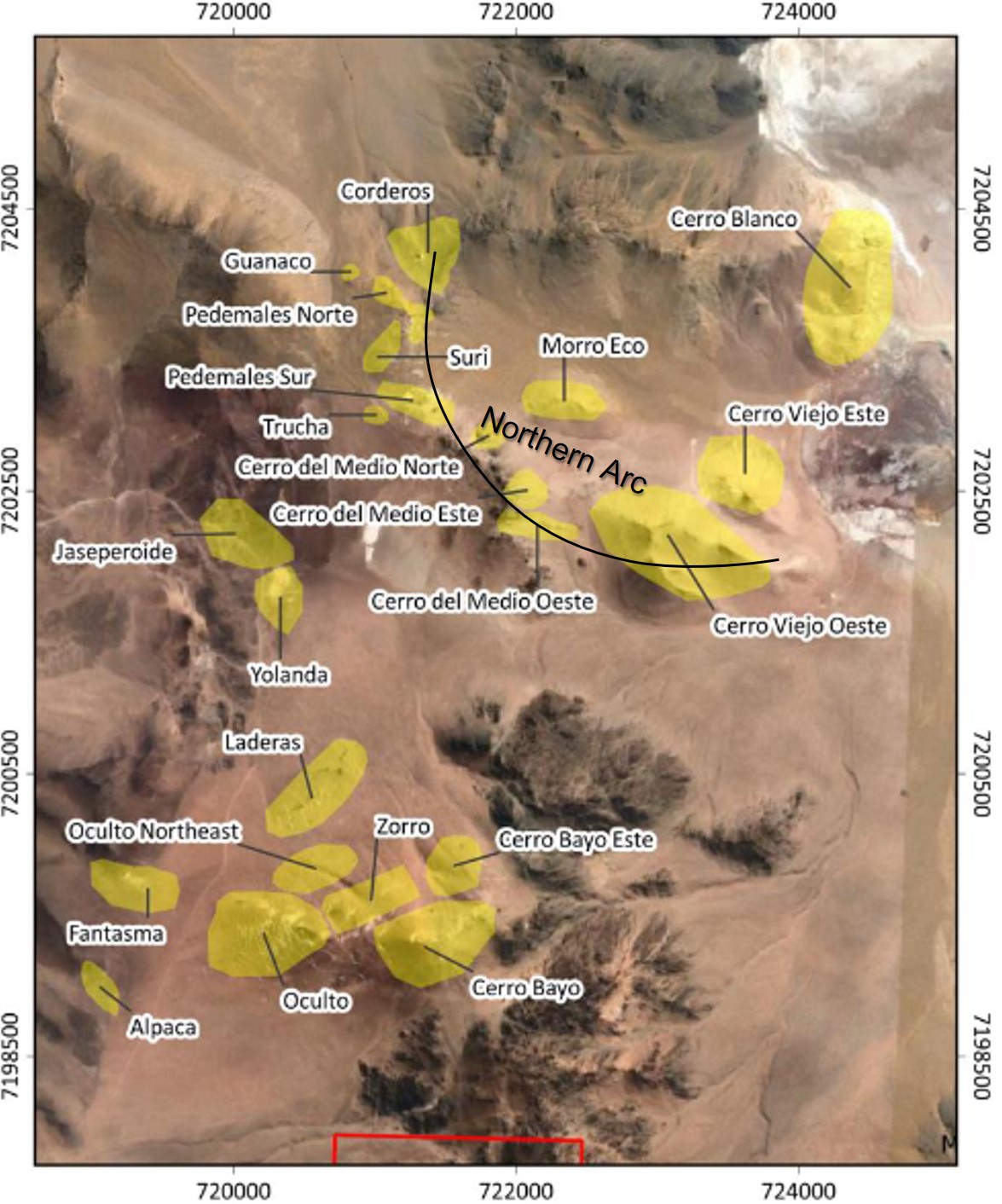

Significant exploration upside remains at the Diablillos Project. Close-range, nearer-term targets include Oculto, Fantasma (a satellite zone of Ag-rich epithermal mineralization related to Oculto), Laderas, and Alpaca. Most of the longer-term distal targets, except for Yolanda, are aligned along a curving trend and are collectively known as the Northern Arc zones. These zones include the Cerro Viejo Este and Oeste, the Cerro del Medio Norte, Pedernales, and Corderos. This group of prospects lies approximately three to four kilometers north-northeast of the center of the Oculto deposit. All encompass epithermal silver-gold targets similar in style to Oculto, and one, Cerro Viejo, shows potential for porphyry mineralization.

An updated November 2023 resource report is in the table below.

| Diablillos Mineral Resource Statement, Effective as of November 22, 2023 | |||||||||

|

Deposit |

Zone |

Category |

Tonnes (000 t) |

Grade |

Contained Metals |

||||

|

Ag (g/t) |

Au (g/t) |

AgEq (g/t) |

Ag (koz) |

Au (koz) |

AgEq (koz) |

||||

|

Oculto |

Oxides |

Measured |

12,170 |

101 |

0.95 |

178 |

39,519 |

372 |

69,523 |

|

Indicated |

34,654 |

64 |

0.85 |

133 |

71,306 |

947 |

147,748 |

||

|

Measured & Indicated |

46,824 |

74 |

0.88 |

145 |

111,401 |

1,325 |

218,335 |

||

|

Inferred |

3,146 |

21 |

0.68 |

76 |

2,124 |

69 |

7,677 |

||

|

JAC |

Oxides |

Measured |

1,870 |

210 |

0.17 |

224 |

12,627 |

10 |

13,452 |

|

Indicated |

3,416 |

198 |

0.12 |

208 |

21,744 |

13 |

22,808 |

||

|

Measured & Indicated |

5,286 |

202 |

0.13 |

212 |

34,329 |

22 |

36,191 |

||

|

Inferred |

77 |

77 |

- |

77 |

190 |

- |

190 |

||

|

Fantasma |

Oxides |

Measured |

- |

- |

- |

- |

- |

- |

- |

|

Indicated |

683 |

105 |

- |

105 |

2,306 |

- |

2,306 |

||

|

Measured & Indicated |

683 |

105 |

- |

105 |

2,306 |

- |

2,306 |

||

|

Inferred |

10 |

76 |

- |

76 |

24 |

- |

24 |

||

|

Laderas |

Oxides |

Measured |

- |

- |

- |

- |

- |

- |

- |

|

Indicated |

464 |

16 |

0.91 |

89 |

239 |

14 |

1,334 |

||

|

Measured & Indicated |

464 |

16 |

0.91 |

89 |

239 |

14 |

1,334 |

||

|

Inferred |

55 |

43 |

0.57 |

89 |

76 |

1 |

157 |

||

|

Total |

Oxides |

Measured |

14,040 |

116 |

0.85 |

184 |

52,146 |

382 |

82,975 |

|

Indicated |

39,217 |

76 |

0.77 |

138 |

95,594 |

974 |

174,196 |

||

|

Measured & Indicated |

53,257 |

87 |

0.79 |

151 |

148,275 |

1,360 |

258,087 |

||

|

Inferred |

3,288 |

23 |

0.66 |

76 |

2,415 |

70 |

8,049 |

||

The above resource data was from the Abra Silver Resource Corp. 2023 NI-43-101 Technical Report Minerals Resource Estimate – Diabillos Project, Salta province Argentina. Effective date: January 10, 2024. QP: Luis Rodrigo Peralta, FAusIMM CP (Geo). EMX has not done sufficient work to classify the resource as compliant with NI 43-101 regulation. However, EMX believes these results to be reliable and relevant.

Mineral Resources have been estimated in accordance with CIM guidelines. Contained metal does not take into account recovery losses. The Mineral Resources represent the most recent publicly disclosed estimates for Diablillos.

Notes:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The formula for calculating AgEq is as follows: Silver Eq oz = Silver oz + Gold oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

- The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate.

- The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$24.00/oz Ag price, US$1,850/oz Au price, 82.6% process recovery for Ag, and 86.5% process recovery for Au. The constraining open pit optimization parameters used were US$1.94/t mining cost, US$22.97/t processing cost, US$3.32/t G&A cost, and average 51-degree open pit slopes.

- The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- A Net Value per block (“NVB”) cut-off was used to constrain the Mineral Resource with the conceptual open pit. The NVB was based on “Benefits = Revenue-Cost” being positive, where, Revenue = [(Au Selling Price (US$/oz) - Au Selling Cost (US$/oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (US$/oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Revenue]. The NVB method resulted in an average equivalent cut-off grade of approximately 45g/t AgEq.

- The Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods.

- In-situ bulk density was assigned to each model domain, according to samples averages of each lithology domain, separated by alteration zones and subset by oxidation.

- All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

- The Mineral Resource was estimated by Mr. Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101.

- Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

- Totals may not agree due to rounding.

In Q1 2024, AbraSilver announced results from a Pre-Feasibility Study for the Diablillos project (see AbraSilver news release dated March 25, 2024). The open pit constrained oxide mineral reserves for “all domains” were reported as:

| Diablillos Mineral Reserve Statement, Effective as of March 7, 2024 | |||||||

|

Category |

Tonnes (000 t) |

Grade |

Contained Metals |

||||

|

Ag (g/t) |

Au (g/t) |

AgEq (g/t) |

Ag (koz) |

Au (koz) |

AgEq (koz) |

||

|

Proven |

12,364 |

118 |

0.86 |

185 |

46,796 |

341 |

73,352 |

|

Probable |

29,930 |

80 |

0.80 |

142 |

76,684 |

766 |

136,267 |

|

Total P&P |

42,294 |

91 |

0.81 |

154 |

123,480 |

1,107 |

209,619 |

Notes:

- The Qualified Person for the Mineral Reserve Estimate is Mr. Miguel Fuentealba, P.Eng.

- The mineral reserves were based on a pit design which in turn aligned with an ultimate pit shell selected from a WhittleTM pit optimization exercise. Key inputs for that process are: a.) Metal prices of US$1,750/oz Au; US$22.50/oz Ag; b.) Variable Mining cost by bench and material type. Average costs are US$1.94/t for all lithologies except for “cover”. Cover mining cost of US$1.73/t.; c.) Processing costs for all zones, US$22.97/t.; d.) Infrastructure and G&A cost of US$3.32/t.; e.) Pit average slope angles varying from 37° to 60°; f.) The average recovery is estimated to be 82.6% for silver and 86.5% for gold.

- A Net Value per block (“NVB”) cut-off was used to constrain the Mineral Reserve within the reserve pitshell. The NVB was based on “Benefits = Revenue-Cost” being positive, where, Revenue = [(Au Selling Price (US$/oz) - Au Selling Cost (US$/oz)) x (Au grade (g/t)/31.1035)) x Au Recovery(%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (US$/oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Revenue]. The NVB method resulted in an average equivalent cut-off grade of approximately 46g/t AgEq.

- All tonnages reported are dry metric tonnes and ounces of contained metal are troy ounces.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

Maps

Photos

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge