Kaukua

Location

Finland

Operator

GT Resources Inc.

Commodity

PGE-Nickel-Copper-Gold

Royalty

2% NSR

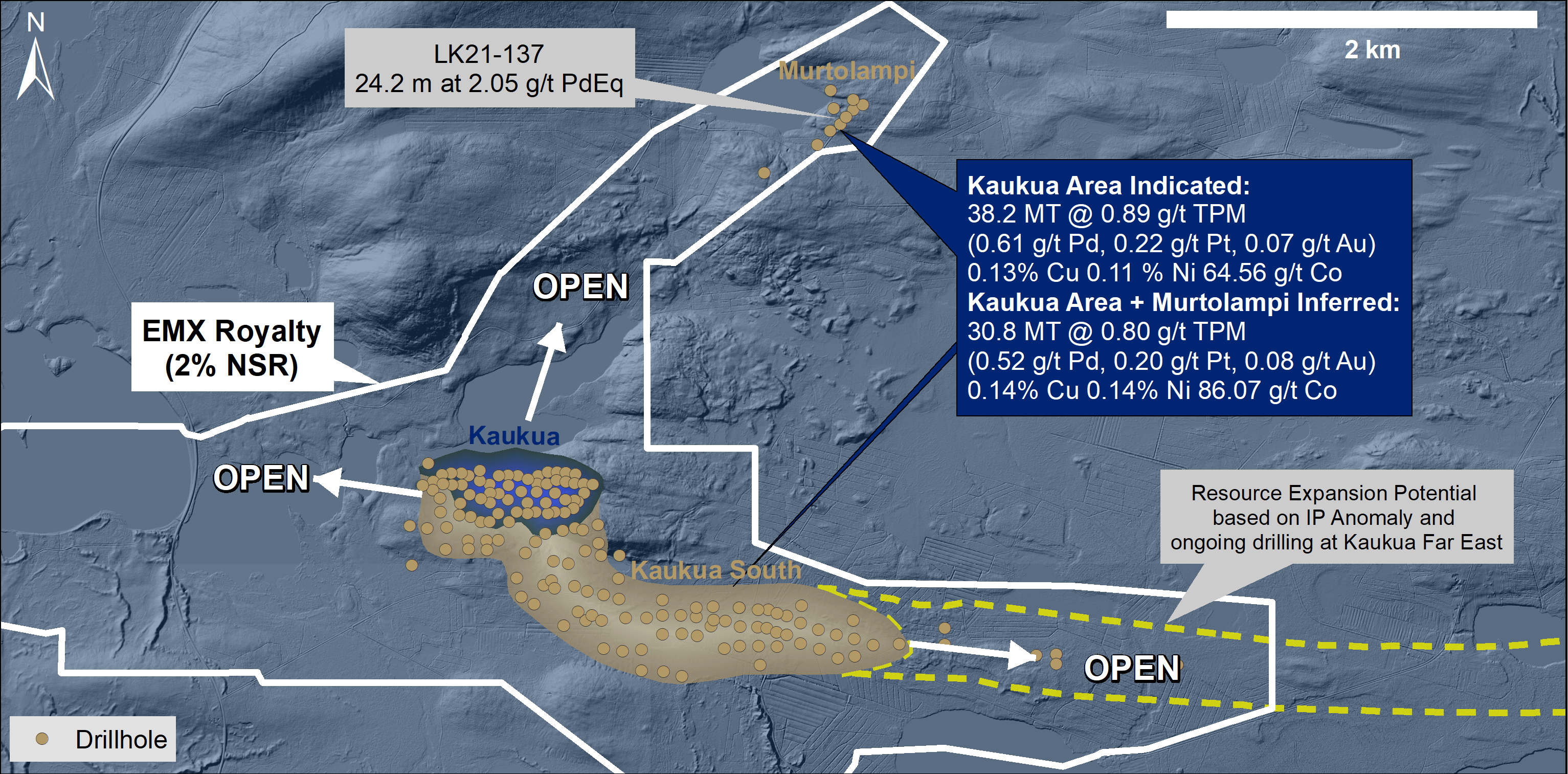

EMX acquired a 2% Net Smelter Returns (“NSR”) royalty on various exploration licenses totaling just over 1,000 hectares in Finland from Akkerman Exploration B.V., a private Netherlands company (see EMX news release dated February 25, 2020). The Kaukua Royalty licenses host PGE mineralization at GT Resources Inc.’s (formerly Palladium One) Läntinen Koillismaa (“LK”) project in Finland. An updated mineral resource estimate for the LK PGE project’s Kaukua deposit was announced in April 2022 by Palladium One1, and the current Kaukua Technical Report can be found at www.Sedar.com. The Kaukua deposit lies within the Kaukua Royalty property.

PGE-nickel-copper-gold mineralization at the Kaukua deposit is hosted by the Koillismaa Layered Igneous Complex (“KLIC”), a 2.4-2.5 billion year old layered mafic intrusive complex located in north-central Finland. The KLIC forms part of an east-west trending belt of similar intrusions and nickel, copper and PGE deposits that cross through Finland and into Russia.

The Company’s Kaukua Royalty also covers multiple additional exploration targets including the majority of the “South Zone”, a drill defined zone of mineralization which occurs 500 meters south of the main Kaukua deposit. The Technical Report also highlights exploration potential to the east and west of the Kaukua deposit, concealed beneath shallow overburden.

PGE-rich styles of mineralization were first recognized at Kaukua by Outokumpu Oy in the late 1980’s. The Geological Survey of Finland (“GTK”) commenced a focused research and exploration program in the area in 1996, drilling the Kaukua project for the first time in 2004, resulting in drill defined zones of PGE-rich mineralization. Akkerman acquired the Kaukua licenses in 2007 via direct application, and subsequently optioned the rights of those applications to Nortec Ventures Corp. (“Nortec”).

After acquiring the Kaukua property, Nortec drilled additional holes and completed a resource estimate and NI 43-101 technical report in 2011. The Kaukua licenses were ultimately acquired by Nickel One Resources Inc. in 2017. Nickel One Resources Inc. subsequently changed its name to Palladium One Mining Inc. in May, 2019, and again to GT Resources Inc. in March, 2024.

GT Resources has disclosed updated Mineral Resources for the Kaukua deposit, as well as the nearby Murtolampi deposit, both of which are covered by EMX’s NSR royalty1,2. The open pit constrained Mineral Resources are summarized in the tables below (note: TPM is Total Precious Metals defined as Pd+Pt+Au).

|

|

Strip Ratio |

Tonnes (Mt) |

Grade |

Contained Metal |

||||||||||||

|

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

TPM (g/t) |

Cu (%) |

Ni (%) |

Co (g/t) |

Pd (Moz) |

Pt (Moz) |

Au (Moz) |

TPM (Moz) |

Cu (Mlbs) |

Ni (Mlbs) |

Co (Mlbs) |

|||

|

Indicated (Kaukua Area) |

1.50 |

38.2 |

0.61 |

0.22 |

0.07 |

0.89 |

0.13 |

0.11 |

64.56 |

0.74 |

0.26 |

0.08 |

1.09 |

110.7 |

91.6 |

5.4 |

|

Inferred (Kaukua Area + Murtolampi) |

1.45 |

30.8 |

0.52 |

0.20 |

0.08 |

0.80 |

0.14 |

0.14 |

86.07 |

0.52 |

0.20 |

0.07 |

0.79 |

96.5 |

93.9 |

5.8 |

1 See Palladium One news release dated April 25, 2022

2 “Technical Report on the Läntinen Koillismaa Project, Finland”, dated April 25, 2022 by Sean Horan, P.Geo., Qualified Person (QP)

- The MRE follows 2014 CIM Definition Standards and the 2019 CIM MRMR Best Practice Guidelines.

- The Mineral Resources have been reported above a preliminary open pit constraining surface using a net smelter return (NSR) pit discard cut-off of US$12.5/t (which, for comparison purposes, equates to an approximately 0.65 g/t palladium equivalent (PdEq) in-situ cut-off grade, based on metal prices only).

- The NSR used for reporting is based on the following: I. Long term metal prices of US$1,700/oz Pd, US$1,100/oz Pt, US$1,800/oz Au, US$4.25/lb Cu, US$8.50/lb Ni, and US$25/lb Co; II. Variable metallurgical recoveries for each metal were used at Kaukua and Murtolampi and fixed recoveries of 79.8% Pd, 80.1% Pt, 65% Au, 89% Cu, 64% Ni, and 0% Co at Haukiaho; III. Commercial terms for a Cu and Ni concentrate based on indicative quotations from smelters.

- Total Precious Metals (TPM) equals palladium plus platinum plus gold.

- Bulk densities range between 1.8 t/m3 and 3.23 t/m3.

- Numbers may not add up due to rounding.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The quantity and grade of reported Inferred Mineral Resources in this estimation are conceptual in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

EMX notes that recoveries and net smelter returns are assumed to be 100% for the Pd Eq calculation.

EMX has not done sufficient work to classify the sampling and intercepts as compliant with NI 43-101 regulation, and these results should not be relied upon until they are confirmed. However, EMX believes these results to be reliable and relevant

Click to Enlarge

Click to Enlarge