Vancouver, British Columbia, May 10, 2021 (NYSE American: EMX; TSX Venture: EMX; Frankfurt: 6E9) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce the execution of an agreement with Gold Line Resources Ltd. (TSX-V: GLDL) (“Gold Line”) to transfer EMX’s newly acquired exploration reservation in Finland’s Oijärvi greenstone belt (the “Oijärvi Extension” or the “Property”) to Gold Line. EMX will retain a 3% net smelter return (“NSR”) royalty on the Property, 1% of which can be repurchased, and will be reimbursed its acquisition expenses in addition to other considerations. In essence, the Oijärvi Extension will be added as an additional property under the terms of its 2019 agreement with Gold Line (see EMX News Release dated April 4, 2019).

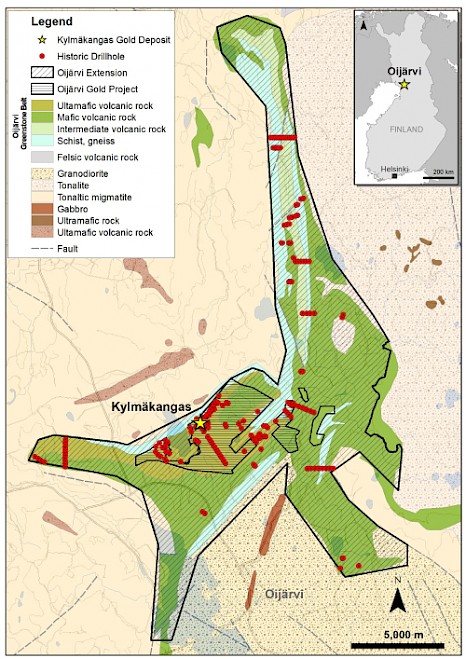

The Oijärvi Extension is an exploration “reservation” in Finland that covers a 25 kilometer long extension of the Oijärvi Greenstone Belt, where Gold Line recently announced the acquisition of the Oijärvi Gold Project from Agnico Eagle Mines Ltd (“Agnico”) (See EMX and Gold Line news releases dated March 22, 2021). The Property extends along strike of the greenstone belt to the southwest and northeast of the Oijärvi Gold Project. EMX will retain the NSR royalty on the Oijärvi Extension to complement its right to purchase a 1% NSR on the Oijärvi Gold Project for US $1 million. This further expands EMX’s royalty exposure to include the entire Oijärvi Greenstone Belt.

The Oijärvi Extension is considered highly prospective in light of Agnico’s success at Oijärvi, where it delineated the Kylmäkangas deposit with a historic resource reported as 1.89 million tonnes (Mt) grading 4.11 grams per tonne (g/t) gold (Au) yielding 250,000 oz Au and 31.11 g/t silver (Ag) yielding 1,896,000 oz Ag1.

Relatively little exploration has taken place outside of the Kylmäkangas zone. A total of 217 holes have been drilled in the broader Oijärvi greenstone belt outside of Kylmäkangas with an average depth of ~150 meters. Most of that drilling was in widely spaced fences of historical holes drilled by the Geological Survey of Finland (GTK) across the trend of the greenstone belt (see Figure 1). This represents a low drill density in an otherwise prospective belt-scale property.

Commercial terms overview.

- At closing, EMX will transfer to Gold Line its interests in the Oijärvi Extension Property.

- At closing, Gold Line will issue to EMX approximately 1,125,000 common shares of Gold Line that will bring EMX’s holdings in Gold Line to 9.9% of its issued and outstanding share capital.

- EMX will receive an uncapped 3% NSR royalty on the Project. Within six years of the closing date Gold Line has the right to buy down up to 1% of the royalty owed to EMX (leaving EMX with a 2% NSR) by paying EMX 2,500 ounces of gold, or its cash equivalent.

- EMX will receive annual advance royalty (“AAR”) payments of 30 ounces of gold on the Project, commencing on the second anniversary of the closing, with each AAR payment increasing by five ounces of gold per year up to a maximum of 75 ounces of gold per year. These AAR payments may be made in gold bullion, its cash equivalent, or its value equivalent in shares of Gold Line, subject to certain conditions.

- Gold Line will also reimburse EMX for its Oijärvi Extension acquisition costs.

Oijärvi Gold Project. The Oijärvi Gold Project is a 1,641 hectare advanced exploration project located approximately 350 kilometers (km) south of Agnico’s Kittilä Mine and 85 km east of the city of Kemi, Finland. The project is located within an Archean-age greenstone belt (known as the Oijärvi Greenstone Belt), very similar to those found elsewhere in Finland and in the Canadian Shield. The project contains several zones of gold mineralization highlighted by the drill-defined Kylmäkangas deposit, with its historical inferred mineral resource. The Kylmäkangas zone remains open at depth and along strike towards the southwest and northeast, and there is evidence of other parallel gold mineralized trends elsewhere on the project.

Extensions of the Oijärvi Greenstone Belt. The Oijärvi Greenstone Belt extends for a further 20 kilometers northeast of Kylmäkangas, and a further five kilometers to the southwest. EMX and Gold Line believe the entirety of this belt to be highly prospective for further discoveries. Notably, reconnaissance drilling 1.8 km to the southwest of the Kylmäkangas deposit also intersected gold mineralization in the same stratigraphic position as Kylmäkangas with little to no drilling in between. This same stratigraphic horizon remains untested further to the southwest within the Oijärvi Extension Property.

Together with the Oijärvi Gold Project and the newly acquired Oijärvi Extension Property, Gold Line now wholly controls an emerging gold belt in Finland, with EMX strengthening its position as both a strategic shareholder in Gold Line and royalty holder on the assets. EMX will continue to assist with advancement of the projects in its technical advisory role with Gold Line.

Comments on Historical Drill Results and Resource Estimate, and Nearby Mines and Deposits. EMX has not performed sufficient work to verify the projects’ historical drill results and the Kylmäkangas historical resource estimate, but considers this information as reliable and relevant based upon independent field review, including inspection and resampling of historical drill core. Agnico’s Kylmäkangas Au-Ag historical resource estimate was based upon: angle core drilling and fire assaying of half-core samples, a 3D model of the geologic controls (e.g., shear-hosted steeply dipping quartz veining and brecciation) to the Au-Ag mineralization based upon reconciled interpretations on section and plan, inverse distance squared interpolation with controls to assay outliers that included grade capping, and reporting based upon a 2 g/t cutoff grade.

The nearby mines and deposits discussed in this news release provide context for the projects, which occur in a similar geologic setting, but this is not necessarily indicative that the projects host similar mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol EMX. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

Ibelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential”, “upside” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the year ended December 31, 2020 (the “MD&A”), and the most recently filed Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

1See Agnico News Release dated February 13, 2013: Agnico-Eagle Reports Fourth Quarter and Full Year 2012 Results; Record Annual Production and Operating Cash Flows; Provides Three Year Production Guidance and Reserve and Resource Update; also unpublished Agnico Eagle - Kylmäkangas Au-Ag Mineralization Prospectus Report, effective date July 15, 2019. Note: a qualified person has not done sufficient work to classify the historical resource estimate as a current mineral resource, and EMX is not treating the historical estimate as a current mineral resource. Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimate can be classified as a current mineral resource. The historical resource estimate is presented only for the purpose of describing the extent of gold mineralization and to outline the exploration potential. This historical resource estimate should not be relied upon until verified.