Diablillos

Location

Argentina

Operator

AbraSilver Resource Corp.

Commodity

Silver-Gold

Royalty

1% NSR

EMX has a 1% NSR royalty on the Diablillos project. Diablillos is a high sulfidation silver-gold & copper-gold porphyry intrusive at depth project, located in the Puna region of the Province of Salta, Argentina and is operated by AbraSilver Resource Corp. (TSX-V: ABRA, “AbraSilver”). AbraSilver has executed their option to acquire 100% of the Diablillos property with an early final property payment of $6,850,000 in Q2 2025 (see EMX Press Release dated April 10, 2025).

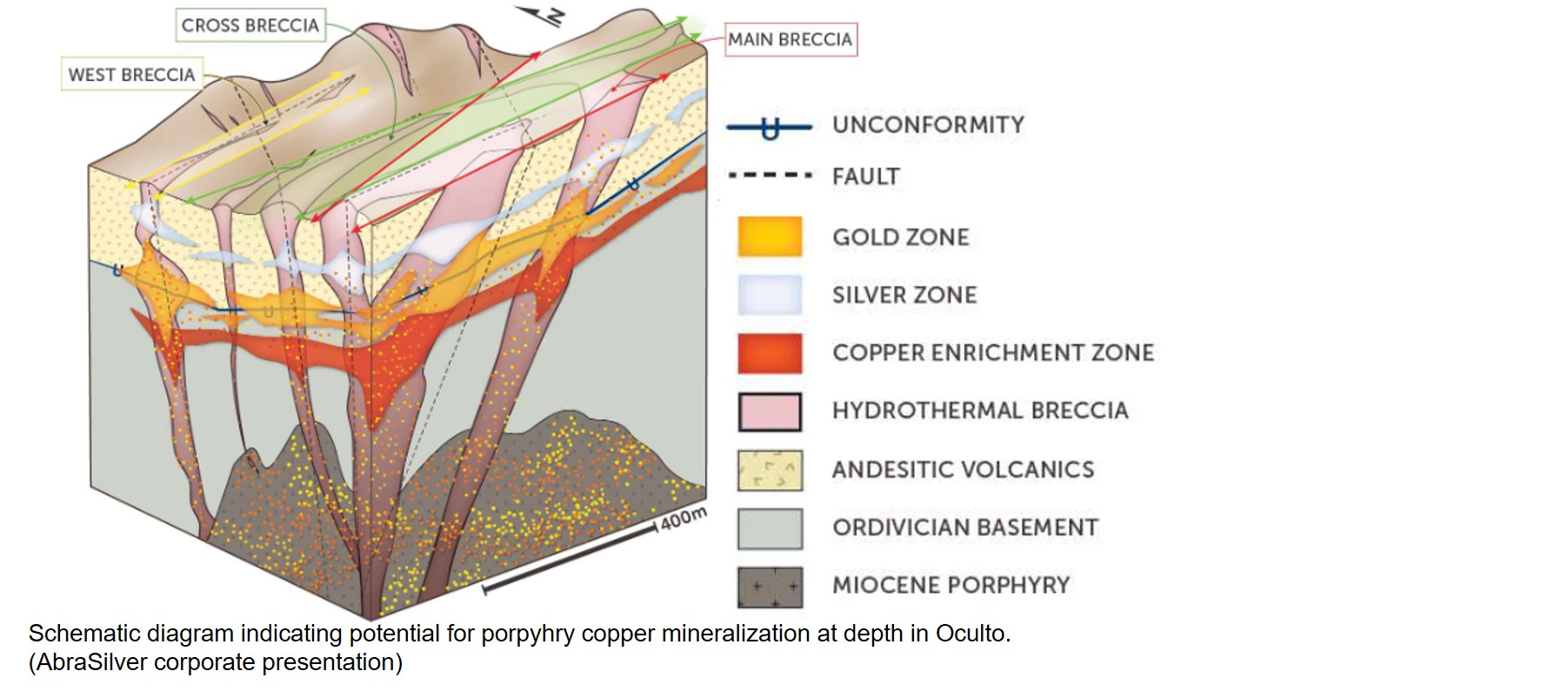

There are currently several known mineralized zones on the Diablillos property, with the Oculto zone being the most important and the most explored. Oculto is a deeply oxidized, high-sulfidation epithermal silver-gold deposit. Recent surface mapping and drill data interpretation indicates that high grade mineralization at Oculto is strongly correlated with steeply dipping, tabular, hydrothermal breccia bodies oriented along northeast-trending faults. Recent drilling confirmed that these hydrothermal breccias continue into the basement and identified high-grade copper intercepts up to 5% Cu, suggesting the potential for deeper porphyry-style mineralization.

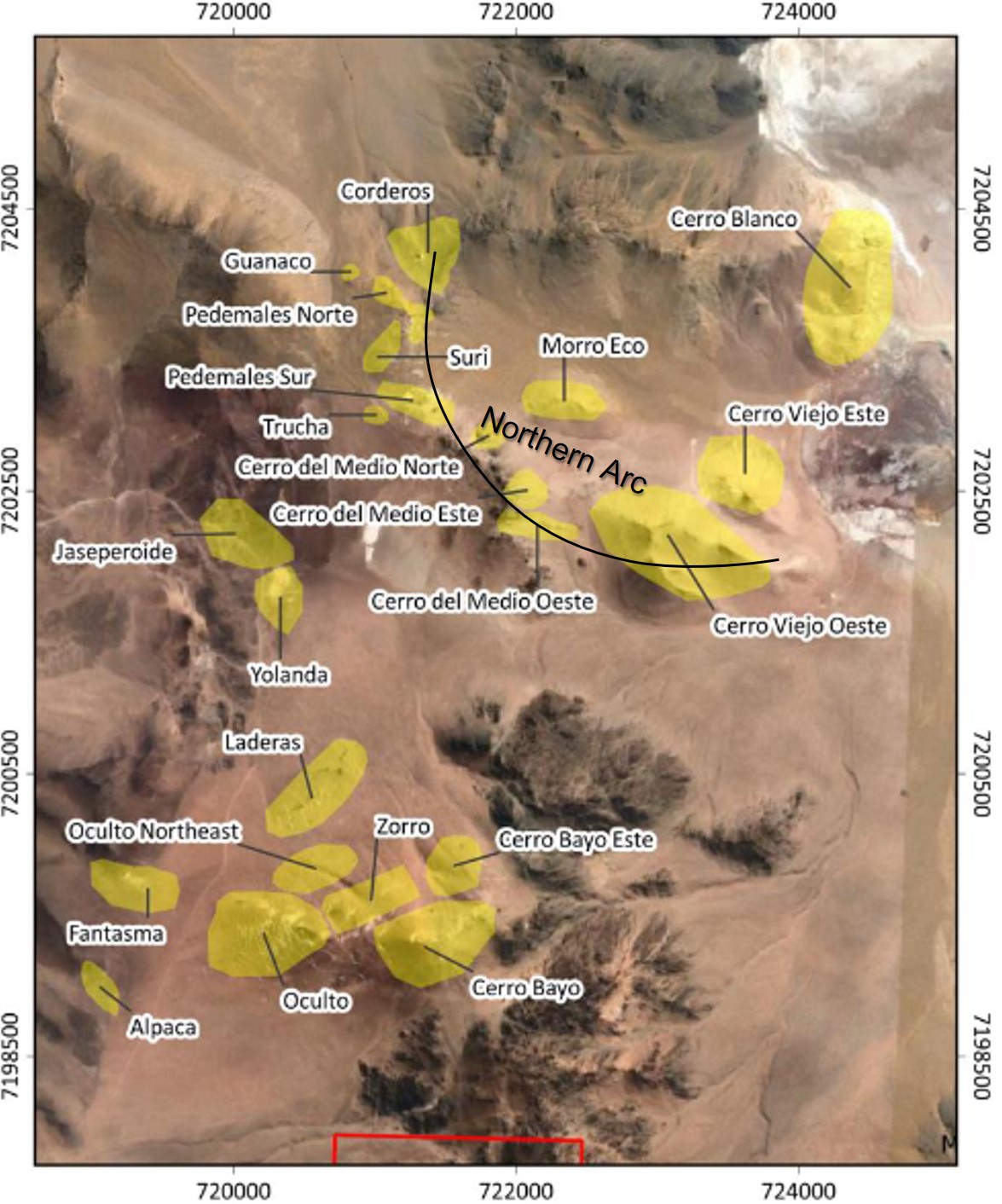

Significant exploration upside remains at the Diablillos Project. Close-range, nearer-term targets include Oculto, Fantasma (a satellite zone of Ag-rich epithermal mineralization related to Oculto), Laderas, and Alpaca. Most of the longer-term distal targets, except for Yolanda, are aligned along a curving trend and are collectively known as the Northern Arc zones. These zones include the Cerro Viejo Este and Oeste, the Cerro del Medio Norte, Pedernales, and Corderos. This group of prospects lies approximately three to four kilometers north-northeast of the center of the Oculto deposit. All encompass epithermal silver-gold targets similar in style to Oculto, and one, Cerro Viejo, shows potential for porphyry mineralization.

AbraSilver published an updated Mineral Resource Estimate for the Diablillos project in 2025 and a Pre-Feasibility Study in Q1 2024, summarized in the tables below.

| Mineral Resource Statement - Effective as of July 21, 2025 | |||||||||

| Zone | Category | Tonnes (kt) | Grade | Contained Metals | |||||

| Ag (g/t) | Au (g/t) | AgEq (g/t) | Ag (koz) | Au (koz) | AgEq (koz) | ||||

| Tank Leach | Oxides | Measured | 26,545 | 119 | 0.71 | 183 | 101,564 | 604 | 156,487 |

| Indicated | 46,584 | 56 | 0.63 | 114 | 84,430 | 948 | 170,592 | ||

| M+I | 73,129 | 79 | 0.66 | 139 | 185,994 | 1,553 | 327,078 | ||

| Inferred | 9,693 | 34 | 0.57 | 86 | 10,616 | 176 | 26,647 | ||

| Heap Leach | Oxides | Measured | 6,673 | 16 | 0.14 | 25 | 3,486 | 30 | 5,342 |

| Indicated | 24,102 | 12 | 0.17 | 23 | 9,163 | 133 | 17,506 | ||

| M+I | 30,774 | 13 | 0.16 | 23 | 12,649 | 162 | 22,848 | ||

| Inferred | 10,024 | 9 | 0.2 | 21 | 2,811 | 64 | 6,850 | ||

| Total | Oxides | Measured | 33,218 | 98 | 0.59 | 152 | 105,050 | 634 | 161,829 |

| Indicated | 70,686 | 41 | 0.48 | 83 | 93,593 | 1,081 | 188,098 | ||

| M+I | 103,904 | 59 | 0.51 | 105 | 198,643 | 1,715 | 349,927 | ||

| Inferred | 19,628 | 21 | 0.38 | 53 | 13,427 | 241 | 33,496 | ||

| Mineral Reserve Statement - Effective as of March 7, 2024 | |||||||

| Category | Tonnes (kt) | Grade | Contained Metals | ||||

| Ag (g/t) | Au (g/t) | AgEq (g/t) | Ag (koz) | Au (koz) | AgEq (koz) | ||

| Proven | 12,364 | 118 | 0.86 | 185 | 46,796 | 341 | 73,352 |

| Probable | 29,930 | 80 | 0.8 | 142 | 76,684 | 766 | 136,267 |

| Total P+P | 42,294 | 91 | 0.81 | 154 | 123,480 | 1,107 | 209,619 |

Diablillos Resource Notes:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

- The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate.

- The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 27.50/oz Ag price, US $2,400/oz Au price, 83% process recovery for Ag, and 87% process recovery for Au.

- The constraining open pit optimization parameters used were US $1.94/t mining cost, US $22.96/t processing cost, US $3.32/t G&A cost, and average 51-degree open pit slopes.

- The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the “Benefits = Income-Cost”, where, Income = [(Au Selling Price (US$/oz) - Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income]

- The Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit and tank leach processing methods.

- In-situ bulk density were assigned to each model domain, according to samples averages for each lithology domain, separated by alteration zones and subset by oxidation.

- All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

- The Mineral Resource was estimated by Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101.

- Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

The above resource data was from the AbraSilver Resource Corp. News Release dated July 29, 2026. Effective date: July 21, 2025. QP: Luis Rodrigo Peralta, FAusIMM CP (Geo).

Diablillos Reserve Notes:

- The Mineral Reserves have an effective date of March 07, 2024.

- The Qualified Person for the Mineral Reserves Estimate is Mr. Miguel Fuentealba, P. Eng.

- Mineral Reserves were estimated using the Canadian Code of the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM), Definition of Standards for Mineral Resources and Mineral Reserves, prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

- The Mineral Reserves are based on a pit design which is aligned with the ultimate pit selected during the optimization process performed at Whittle.

- Estimated reserves at a sale price of US$1,750 per ounce of Au and US$22.5 per ounce of Ag.

- Variable mining cost per bench and type of material was applied. Average cost of 1.94 US$/t for all lithologies, except for cover, where a cost of 1.73 US$/t is applied.

- Processing cost for all zones is US$22.97/t.

- Infrastructure, general, and administrative costs amount to US$3.32/ton.

- The average pit angles range from 37° to 60°, depending on the geotechnical zone domain.

- The average recovery is estimated at 82.6% for silver and 86.5% for gold.

- The formula for calculating Ageq is Ag eq oz = Ag oz + Au oz x (Au Price/Ag Price).

- Mineral Reserves Estimates have been categorized according to CIM Standard definitions (CIM, 2014).

- A net value per block (“NVB”) was used to restrict the Mineral Reserves within the pitshell. The NVB is based on “Profit = Revenue - Costs”, being positive, where, Revenue = [(Au Price (US$/oz) - Au Sales Cost (US$/oz) x (Au Grade (g/t)/31.1035))x Au Recovery (%)]+[(Ag Price (US$/oz) - Ag Sales Cost (US$/oz) x (Ag Grade (g/t)/31. 1035) x Ag Recovery (%) and cost as, Cost = Mine Cost (US$/t) + Process Cost (US$/t) + Transportation Cost (US$/t) + General and Administrative Costs (US$/t) + [Royalty Cost (%) x Revenue]. The NVB method matches an equivalent cut-off grade of 46 g/t Ageq.

- In situ density is read directly from the block model, previously assigned for each domain during the mineral resource estimation process, according to averages of samples from each lithological domain, separated by alteration and oxidation zones.

- All tonnages reported are in dry metric tons and ounces of gold and silver contained in troy ounces.

- Mining plan considers 298 Mt of waste rock, corresponding to a waste to ore ratio of 6.7. Waste rock from period -2 is considered CAPEX.

- Ore is considered to be that which complies with profit greater than zero, measured or indicated resource, is within the designed operating phases, oxidation state is oxide, any lithology except cover.

- Recoveries were estimated by geometallurgical domain within each block.

- Figures are approximate due to rounding.

- Au and Ag metal is considered in situ.

The Diablillos reserve data was from the AbraSilver Resource Corp. 2024 NI 43-101 Technical Report Pre-Feasibility Study for the Diablillos Ag-Au Project, Salta & Catamarca Provinces, Argentina. Report date: May 29, 2024. Effective date: March 7, 2024. QP: Miguel Fuentealba Vergara, P. Eng. (Mining) MAusIMM.

EMX has not done sufficient work to classify the resources and reserves as compliant with NI 43-101 regulation. However, EMX believes these results to be reliable and relevant.

Maps

Photos

Click to Enlarge

Click to Enlarge

Click to Enlarge

Click to Enlarge